WASHINGTON - US central bankers face an unenviable task when they gather in Washington next week: tackling persistent inflation without adding to financial sector turmoil after Silicon Valley Bank's rapid collapse.

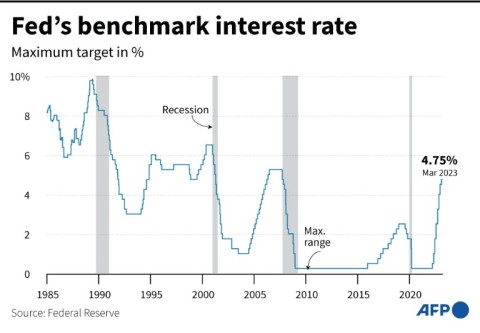

The Federal Reserve has raised rates eight times since last year in the face of decades-high inflation as it looks to cool the economy without tipping it into a recession.

While Fed Chair Jerome Powell earlier signaled willingness to speed up interest rate hikes if needed, most analysts and traders see a small rise of 25 basis points as the most likely outcome on Wednesday at the end of the Fed's two-day meeting.

A quarter-percentage-point hike would match the magnitude of the Fed's last increase in February.

With fears of contagion after the rapid failures of three midsized lenders earlier this month, a minority of observers also believe the Fed could halt its rate increases.

A catalyst for the demise of Silicon Valley Bank (SVB) was the Fed's quick shift from near-zero interest rates to steep hikes, a reversal that swiftly lowered the value of SVB's holdings linked to long-term US Treasury bonds.

Given the market turbulence, a bigger, 50 basis-point hike is now "off the table," Citigroup global chief economist Nathan Sheets said in an interview with AFP.

"My expectation is, it's going to be 25 but it's going to be a debate -- and where markets are next Tuesday and Wednesday is going to be critical," he said.

- Cooler data emerges -

Data for February shows that some corners of the American economy are now beginning to contract -- which eases pressure on the Fed -- while the consumer price index measure of inflation slowed slightly to an annual rate of 6.0 percent.

US retail sales and wholesale prices slipped last month, providing some respite for the Federal Open Market Committee to consider when it mulls another interest-rate hike.

But the Fed's favored measure of inflation showed an annual increase in January, suggesting there is still a long way to go before price rises are brought back under control.

Turmoil in the banking sector is not over either, with many regional banks seeing their stocks plunge again at the end of the week despite intervention by US regulators and some of Wall Street's biggest banks.

"At a minimum, stress in financial markets suggests the Fed should proceed with caution," Bank of America's Gapen said.