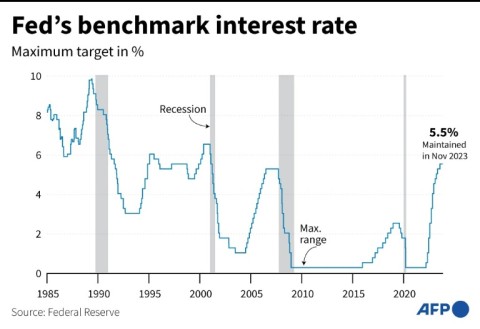

WASHINGTON - The US Federal Reserve is widely expected to hold interest rates at a 22-year high for a third consecutive meeting on Wednesday as it continues to fight elevated inflation.

With the financial markets all but certain that another pause is coming, traders and analysts are now debating how soon the US central bank will start cutting interest rates, and how rapidly it will then do so.

"The given is that there won't be a rate hike," EY Chief Economist Gregory Daco told AFP. "But there's a lot of unknowns as to how the Fed will frame the policy outlook going into next year."

The Fed, which has a dual mandate to lower inflation to its long-term target of two percent while also tackling unemployment, has continued to keep the threat of another rate hike alive.

"It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease," Fed Chair Jerome Powell said recently.

- Progress on inflation -

Recent US economic data point to low unemployment, resilient job creation, positive economic growth and falling inflation.

The latest consumer price index (CPI) showed an annual inflation rate of 3.2 percent, down from a pandemic-era peak of 9.1 percent.

The string of positive data has raised hopes the Fed will meet its dual mandate without plunging the world's biggest economy into a damaging recession -- a rare feat in monetary policy known as a "soft landing."

Much rides on the outcome for President Joe Biden who will seek reelection in 2024.

New numbers came out on Friday showing an increase of 199,000 new jobs last month, and Biden told a crowd in Las Vegas that such steady expansion is what "we call a 'sweet spot' that’s needed for stable growth and lower inflation, not encouraging the Fed to raise interest rates."

In the futures markets, traders have assigned a probability of more than 98 percent that the Fed will sit tight at its next rate decision this week, according to data from CME Group.