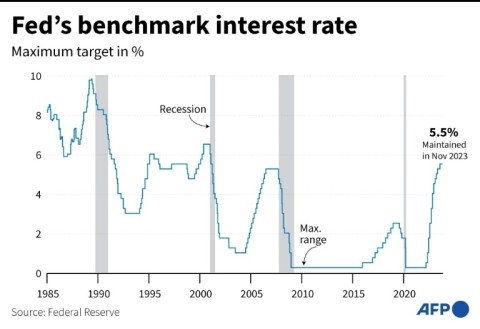

WASHINGTON - The US Federal Reserve will likely hold its key lending rate at a 22-year high on Wednesday -- the first of a series of crucial central bank decisions this week.

With a pause deemed extremely likely, attention is on the language of the Fed's decision, along with its accompanying economic forecasts, and the post-meeting press conference by Fed Chair Jerome Powell.

The Fed, which has a dual mandate to lower inflation to its long-term target of two percent while also tackling unemployment, has continued to keep the threat of another rate hike alive.

"It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease," Powell said recently.

His comments appear to put the Fed at odds with other central banks such as the European Central Bank (ECB), where policymakers have indicated that they are likely done hiking interest rates.

Despite the Fed's aggressive policy of monetary tightening, the world's biggest economy grew at an annualized rate of 5.2 percent in the third quarter.

Headline consumer inflation in the United States fell further last month, according to fresh data published Tuesday, while the unemployment rate has remained close to historic lows.

The data suggest the Fed is on track for a so-called "soft landing," a rare feat in monetary policy when high interest rates bring down inflation without plunging the country into a damaging recession.

But the US economy is not there yet, and so interest rates are likely to remain high for the next few months.

What happens after that is less clear.

The Fed will publish updated economic forecasts on Wednesday, which will shed light on whether or not policymakers still expect half a percentage point of rate cuts in 2024, as they did in September.